Dynamic world of real estate, We are often asked: “Where is the market headed?” Today, let’s take a global flight and explore the fascinating terrain of real estate – its current boom, future trends, and the ever-evolving dance between demand and prices.

A Thriving Market:

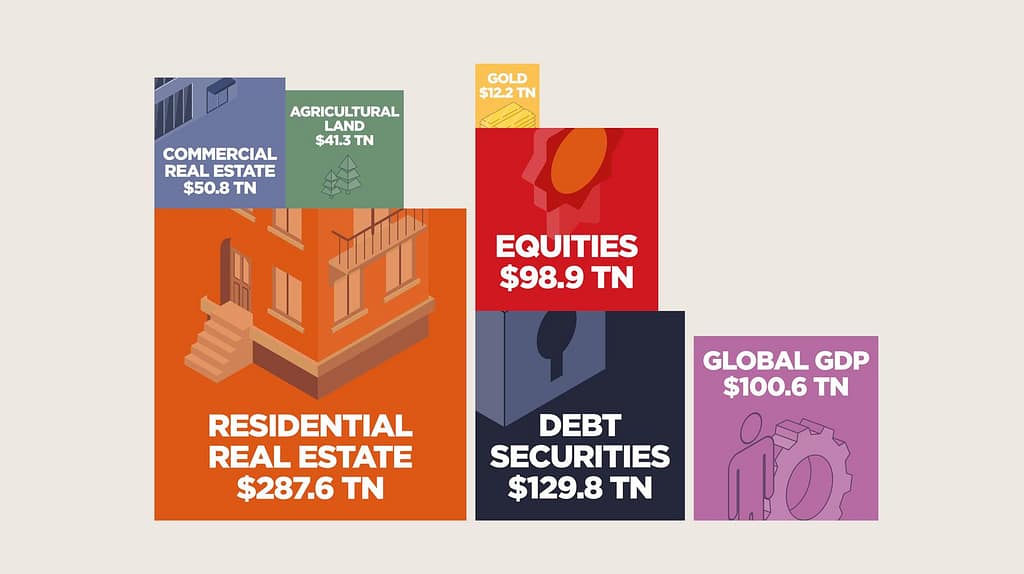

The global real estate market is a behemoth, valued at a staggering $390 trillion at the end of 2023. That’s more than the combined value of the global equity and bond markets! Residential properties have been a leading force, driven by factors like increasing urbanization and low interest rates, which made buying more accessible.

The Price Equation:

While prices have boomed in many regions, there have been recent corrections with rising interest rates. However, the long-term outlook for real estate remains positive. Here’s why:

-

Population Growth:

Our global population is projected to reach 9.7 billion by 2050. This means more people needing homes, offices, and commercial spaces, driving demand.

-

Urbanization on the Rise:

More people are moving to cities, creating a higher concentration of demand for urban real estate.

-

Limited Land Supply:

Land, particularly in prime locations, is a finite resource. Limited supply, coupled with rising demand, puts upward pressure on prices.

Shifting Sands:

The real estate landscape isn’t static. Here are some emerging trends to keep an eye on:

- The Rise of Fractional Ownership:This innovative approach allows people to invest in high-value properties with a lower initial cost, making real estate more accessible. (Here at PCM Group, we’re big believers in this approach!)

- Focus on Sustainability:Eco-friendly buildings with features like renewable energy are becoming increasingly attractive to investors and tenants.

- Technological Advancements:PropTech (property technology) is reshaping the industry, streamlining processes and enhancing transparency.

Investing for the Future:

So, is now a good time to invest in real estate? The answer, as always, depends on your specific goals and risk tolerance. However, the fundamentals remain strong. Real estate offers the potential for long-term capital appreciation and stable rental income, making it a valuable asset class.

Finding Your Piece of the Pie:

Whether you’re a seasoned investor or a first-time buyer, navigating the real estate market can be daunting. That’s where experienced professionals like those at PCM Property Group can come in. We offer expertise in various sectors, from residential and commercial properties to fractional investment options.

The Takeaway:

The global real estate market is dynamic and ever-changing. However, the long-term outlook remains positive. By understanding the key drivers, and emerging trends, and seeking professional guidance, you can make informed decisions and unlock the potential of this exciting asset class.

world’s real estate reached $390 trillion -year’s 2023

In the ever-evolving landscape of global real estate, 2022 marked a period of fluctuation, yet the essence of property as a premier wealth store remains unshaken. According to PCM GROUP Research, the total value of the world’s real estate reached a staggering $390 trillion by the year’s 2023 end, despite experiencing a slight 2.8% dip from the previous year. This subtle decline belies the broader trend, showing an impressive 19% rise over the past three years, reaffirming real estate’s enduring prominence as a bastion of global wealth.

global GDP:

Diving deeper into the numbers, it becomes evident that real estate surpasses even the combined value of global equity and bond markets, towering nearly four times above the global GDP. Remarkably, the value of all the gold ever mined pales in comparison, constituting just over 3% of the total worth of global real estate.

Residential real estate $287.6 trillion by the end of 2022:

Delving into the breakdown of real estate segments, residential property emerges as the undisputed front-runner, commanding over three-quarters of the total real estate value at $287.6 trillion by the end of 2022. Commercial property follows suit, accounting for approximately 13%, while agricultural land claims the remaining 11%.

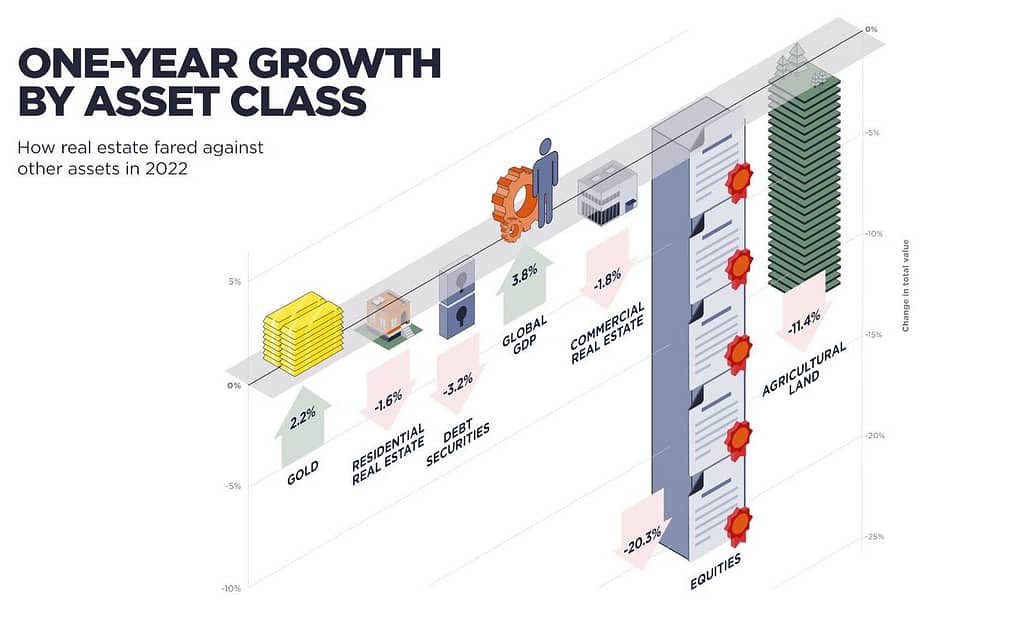

Despite the overall resilience of the real estate market, 2022 presented a year of contrasts. In the initial half, valuations remained robust; however, higher interest rates and mounting economic uncertainties cast a shadow over both residential and commercial markets worldwide, a trend that has persisted into 2023 and 2024.

GOLD:

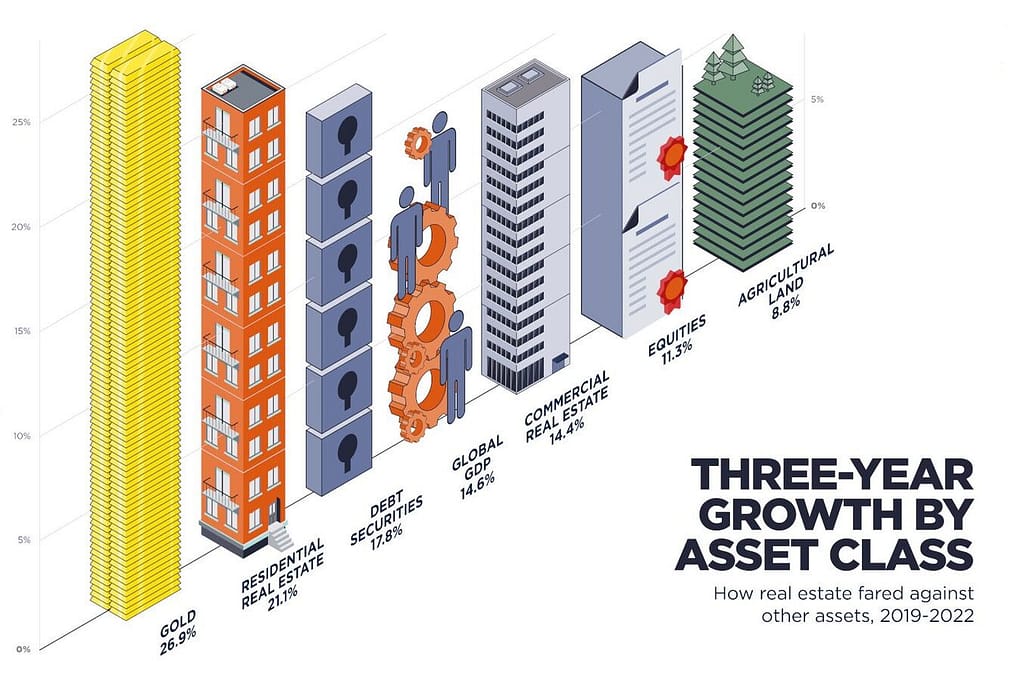

Residential real estate experienced a modest 1.6% decline in 2022, yet its growth over the preceding three years was second only to gold, standing at an impressive 21.1%. This surge can be attributed to ultra low interest rates and a renewed emphasis on the home amid pandemic-related lockdowns.

Similarly, commercial real estate witnessed a marginal decline of 1.8% in 2022, yet it boasted a commendable 14.4% growth over the three-year period. This growth was largely fueled by the conducive low-interest-rate environment and government stimulus measures, enticing investors to allocate substantial capital to real estate ventures.

Agriculture:

Agricultural land experienced a noteworthy 11.4% year-on-year decline in 2022 but showcased an encouraging 8.8% growth over the three-year span. While the pandemic initially dampened agricultural land values in 2020, they rebounded robustly in 2021, only to face setbacks once more in 2023

Equities:

In the broader context of asset comparison, real estate values may have softened in 2022, yet they outshone the struggling bond and equity markets. Debt securities contracted by 3.2%, while equities suffered a substantial 20.3% year-on-year downturn. However, over the past three years, all major asset classes delivered positive growth, with residential property emerging as the standout performer, significantly outpacing bonds and equities.

Amid the economic tumult fueled by the COVID-19 pandemic and subsequent inflation and interest rate hikes, gold witnessed the most substantial value surge, rising by 2.2% over the past year and a staggering 26.9% over three years. Nevertheless, the cumulative value of gold remains dwarfed by the vast expanse of global real estate markets.

global real estate:

As we navigate the global real estate terrain, China retains its position as the world’s most valuable real estate market, accounting for a quarter of the total global real estate value. The United States follows closely behind, representing 19% of the global real estate market. Notably, the G7 nations, alongside China, constitute over two-thirds of the total global real estate value.

Significant concentrations of real estate wealth are observed in Europe and North America, comprising nearly half of the total global real estate value, despite housing only 17% of the global population. In stark contrast, although Asia-Pacific (excluding China) accounts for 37% of the world’s population, it contributes merely 17% to global real estate value. This incongruity underscores the immense growth potential latent within populous nations with burgeoning economies.

In essence, the tale of global real estate is one of resilience, evolution, and enduring value. As we navigate the ever-shifting tides of the real estate market, one thing remains certain: the intrinsic allure and steadfast resilience of property as the cornerstone of global wealth endure, undeterred by the passing storms of economic uncertainty,

It has collective information from world banks and other top financial institution reports,

Thanks and regards